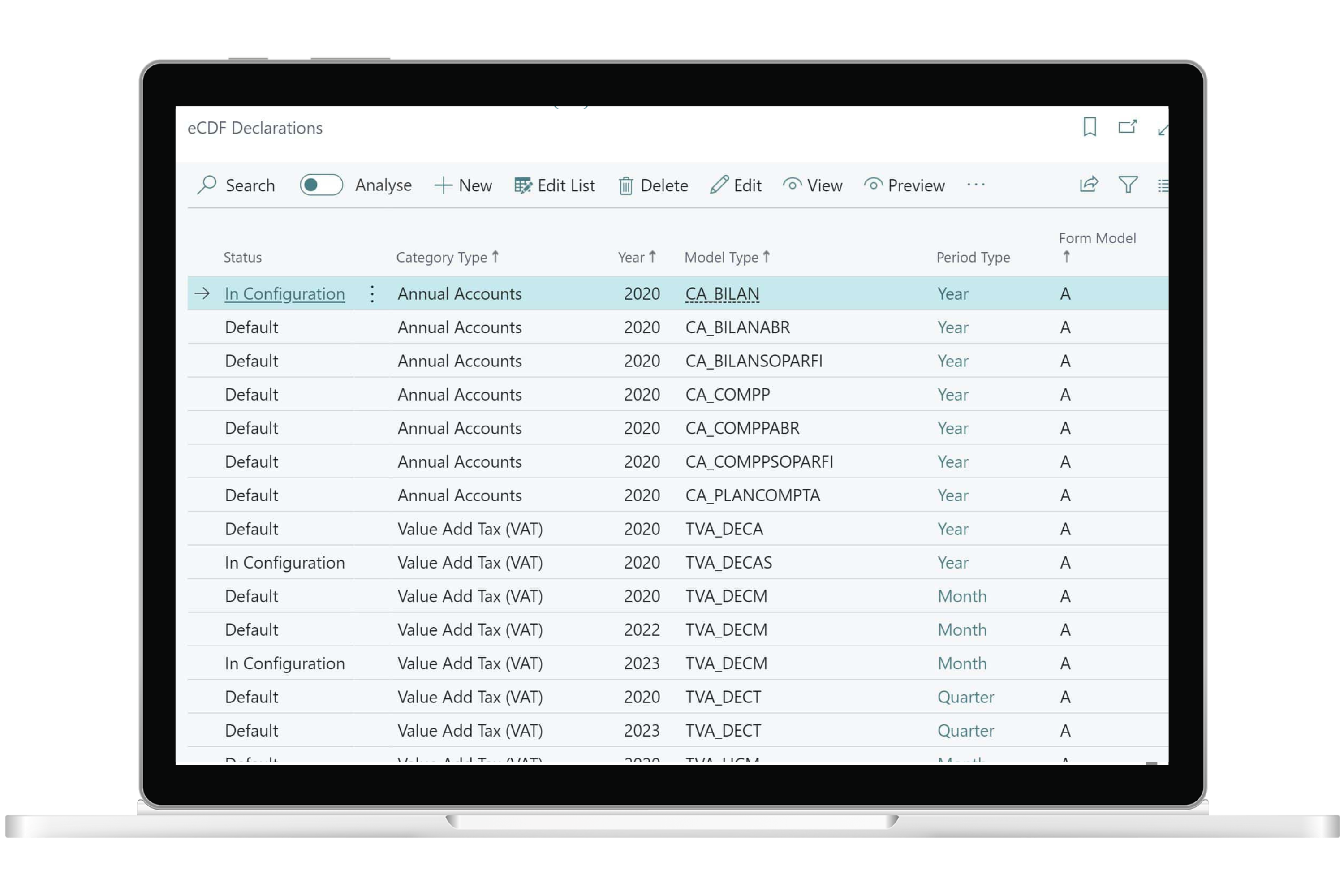

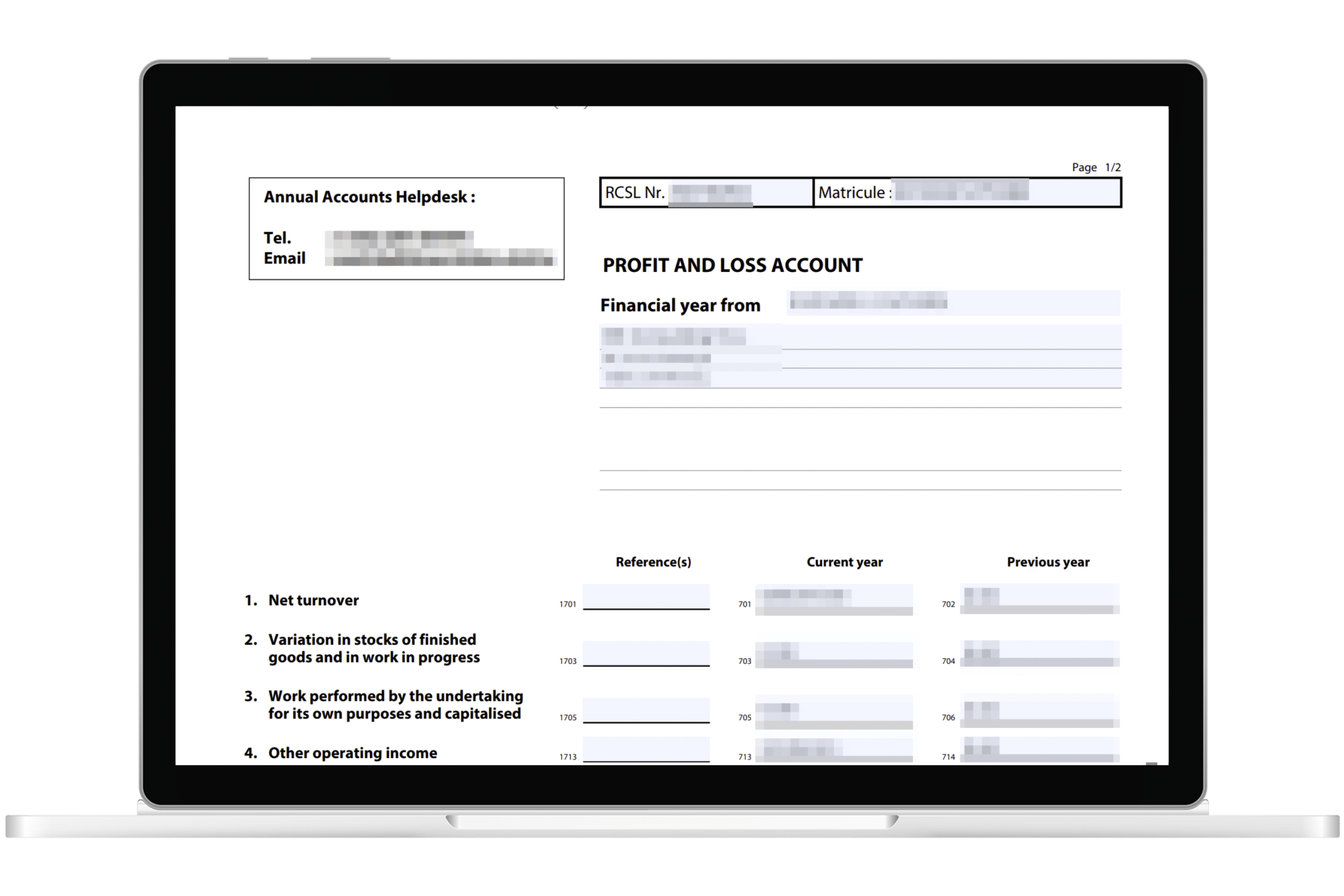

As a business operating in Luxembourg, maintaining Luxembourg VAT compliance regulations is crucial. Fisqal® Localization for Microsoft Dynamics 365 Business Central is the solution that can simplify your tax compliance processes and ensure accuracy. Continue reading to discover more about the VAT in Luxembourg and how Fisqal® Localization can benefit your business.

The application is shipped with a pre-defined standard chart of accounts for Luxembourg (PCN 2020). It’s available in English, French and German. Moreover, it contains a pre-defined accounting setup that enables to use Business Central including some financial reports immediately.

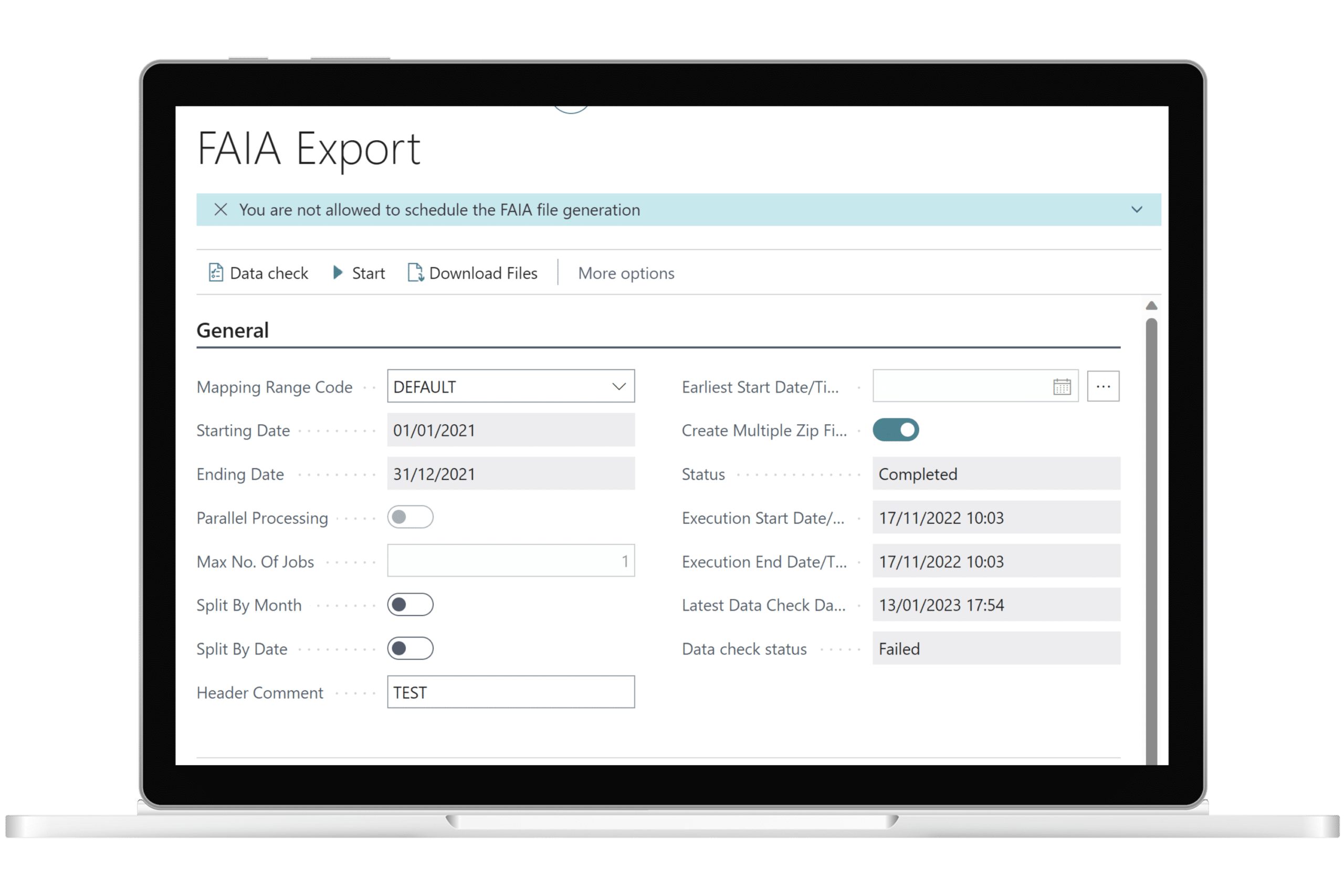

Every company based in Luxembourg must provide the SAF-T FAIA tax audit file upon request by the tax authorities. The FAIA file for Luxembourg is an tax audit file that facilitates the analysis of company data for the Luxembourg tax authorities. It requires additional specific fields and formats.

This particular Luxembourg standard file is used for exporting financial accounting and statistical data during value-added tax audits. As a result, this standard tax audit file must not only include general ledger entries but also all other tax-relevant information.

Any Luxembourg-based business involved in intra-European trade of goods must deliver relevant statistical information and report it to the STATEC portal. The Intrastat data can be exported as a PDF or an Excel (XML) file and subsequently uploaded onto the STATEC declaration platform.

The absence management module allows you to manage your employees holidays, sick leaves and other types of absences. It’s also possible to print draft work contracts and other administrative documents. The module also addresses the specific needs for remote work monitoring in the cross-border working constellation.

Don’t take the risk of non-compliance with Luxembourg’s tax regulations. Acquire Fisqal® Localization for Microsoft Dynamics 365 Business Central today to simplify your tax compliance processes. Contact us now to learn more about this powerful solution and take the first step towards ensuring your business’s tax compliance.

Modern applications made in Luxembourg

© 2023 sk consulting all rights reserved | by ECOM LUX

© 2023 sk consulting all rights reserved | by ECOM LUX

© 2023 sk consulting all rights reserved | by ECOM LUX

Simplifies the tax compliance processes and ensure accuracy.

A paperless solution designed for Fiduciaries and Accounting firms.

Optimizes the creation of payments from customers and vendors with a simplified User Interface.

Organizes your manual invoice processing from start to finish.

Solution that automates employee expense tracking.

Industry Apps

Solution that automates processes and generates detailed reports for many industries.

Security and Compliance

Checks are carried out directly in Microsoft Dynamics 365 Business Central on the contact, on the customer, on the vendor and much more

The Obfuscation app enables you to protect sensitive data in your sandboxes while maintaining usability for testing and development purposes. Personal, confidential and regulated data remains anonymous but your consultants and developers can perform realistic tests.

Using an ERP software can be overwhelming. Many customers struggle with the right setups and getting started. Our Data Management app allows us to remotely manage your setup data so you can get up and running fast.